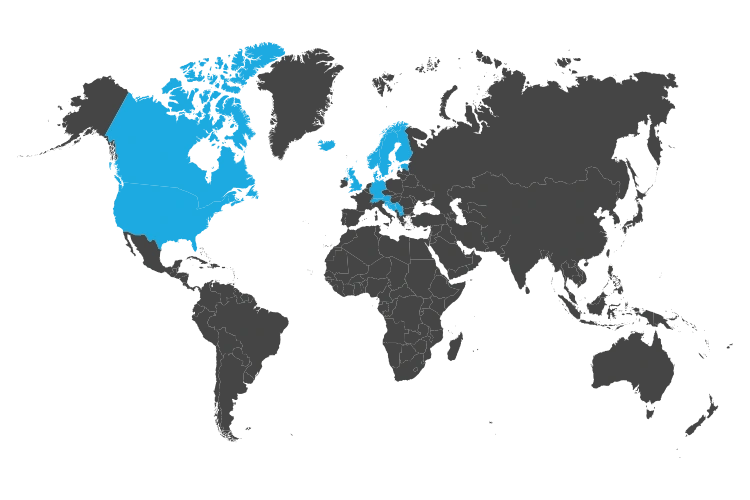

With over 20 years of experience, we have consistently delivered innovative solutions and legacy modernization services to clients across the US, Nordics, DACH, and various other European countries.

We specialize in technology enablement of financial, insurance, automotive, and business management industries serving as externally managed development centers or as project-based partners.

Our expertise spans

- ESG risk management/reporting tools

- Post-trading systems

- Order management / Order execution systems

- Trade risk modeling and margin monitoring

- Advanced data operations systems

- Data analysis / integration solutions

- Lending systems

We’re in for the long and consistent run

MDC

0

%

of TIAC has versatile fintech project experience

2012

1stclient,

MDC made of 3 staff

2024

20th client,

multiple MDCs made of 200+ staff

MDC in numbers

We entered the managed development center space in 2012 as a proposed long-term model of cooperation with a US PE-backed firm. Since then, we have evolved the MDC model and added several other PE-backed firms, startups, and Fortune 500 members.

Our MDC business model growth is the following:

3-5

staff

Usual size of a newly established MDC

10-15

staff

Average MDC size

6+

years

Typical duration of client cooperation resulting in multiple MDCs on various project initiatives

With our clients,

we have delivered and/or implemented

- used by 100s of private and corporate clients across 20+ countries

- <1ms order latency and able to execute 2,000+ orders per second

- 150k+ of trade instruments analysed in real-time

- Processing 2M+ price changes per minute

- Executing 3M+ trades daily

- $1,000B assets analyzed

- 100+ corporate users

- Worldwide usage with 200 countries covered

- $1,000B assets analyzed

- 6+ years of close collaboration with the leading IT solution providers to major insurance groups and financial institutions in Europe and worldwide that resulted in the co-development of both on-prem and cloud SaaS tools such as:

- Advanced risk modeling, proxy fitting tools that adhere to the latest regulations

- Insurance process automation for multi-country operations and custom APIs, cloud migration, poly-cloud implementation, and other fintech/ESG solutions and projects